My goal with this post is to help you understand what mining pools are, why they exist, how they work and the differences between the various pools so you make an informed decision on which mining pool is best for you.

In this post I’ll cover;

- What are mining pools?

- How mining pools work?

- Mining pool payouts explained

- The most prominent mining pools

- Decentralized mining pools

- The future of mining pools

In 2009 when the Bitcoin network first launched, bitcoins were worth very little, so very few people mined them. In the first two years of bitcoin’s history, 2009-2011, most blocks were mined by Satoshi Nakamoto or Hal Finney and a few others.

Because few people were mining during this time, the amount of hashrate required to find a block, or the difficulty, was very low and could even be done with a regular PC CPU or GPU setups.

What are mining pools?

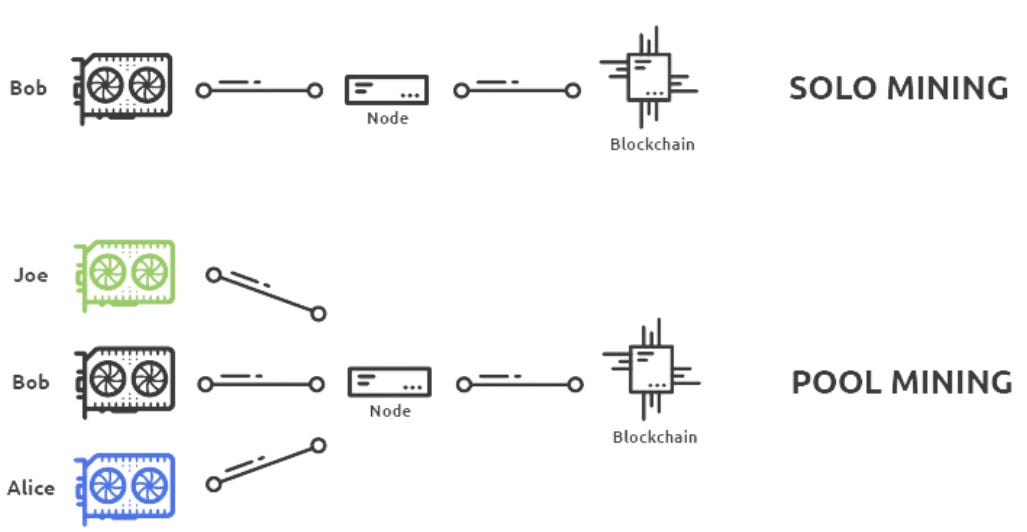

In a mining pool, miners connect to a central server and pool their hashrate.

Mining Pools operate as communication nodes to coordinate the hashrate and distribute mining rewards amoung the miners that are part of the same pool.

The roots of mining pools trace back to the early days of Bitcoin with the goal of addressing the unpredictability of solo mining.

Solo mining is good for miners that care about privacy and want to mine Bitcoin anonymously or for large mining farms that don’t want to be part of a 3rd party pool and have enough miners that they just create a private pool.

Solomining has great rewards if you find a block but the chances are also very low. Especially if you have only a few miners.

That being said, some miners are lottery focused with old/inefficient machines that will likely never earn any rewards through regular mining leave it mining solo just in case it finds a block. “Fingers Crossed”.

Marek Palatinus, nicknamed Slush, successfully implemented the pooled mining concept in 2010 and the 1st mining pool, initially called Bitcoin.cz Mining Pool, launched. It eventually turned into Slush Pool and is now just called Braiins Pool and offered miners a more consistent flow of smaller payouts compared to the sporadic, larger rewards of solo endeavors.

How mining pools work?

At its core, a mining pool is a collaborative effort where miners contribute computational power(hashrate) to solve blocks and confirm transactions.

Mining pools use various operating and payment models, including Pay-per-Share (PPS), Proportional, and Pay-per-Last-N-Shares (PPLNS), each influencing how rewards are distributed among participants.

Pools therefore compete for hashrate based on latency, ease-of-use, payout reliability, and associated networking services. They want you bringing your hashrate to their pool so they can increase the chances of finding a block and also collect fees to operate the pool.

The key benefit of joining a mining pool is the steady income stream and lower technical barrier for miners but it comes with trade-offs. While payouts are more regular, they are smaller and subject to fees that accumulate over time.

There is also the centralization debate that looms large around the big mining pools, challenging the decentralized ethos of Bitcoin.

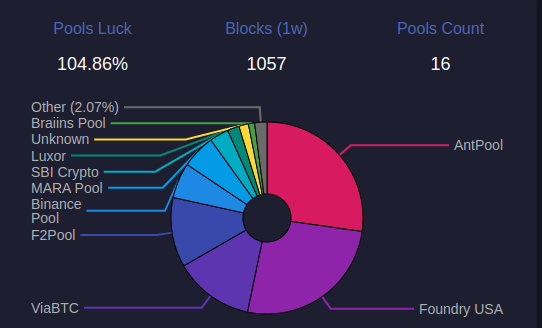

The top two Bitcoin mining pools make up about 176EH/s of the 472 EH/s in the whole network(Nov 2023).

Mining pool payouts explained

There are numerous payment systems (over 15), but the vast majority of mining pools operate on a PPS, FPPS, PPS+, and PPLNS basis.

To understand mining pools, you need an understanding of hashing power, block rewards and transaction fees. Here’s some quick definitions.

Hashing Power – Hash rate is the speed at which a miner completes an operation in the code. A higher hashrate increases a miner’s opportunity of finding the next block and earning the block reward and transaction fees. Most modern ASIC miners have a hashing power in the range of 90th/s to 200th/s.

Block Reward – The Block reward refers to the new coins issued by the network to miners for each successfully solved block. Right now it’s about 6 bitcoin but aroiund April 2024, the next halving will occurr this will drop to 3 bitcoins.

Transaction Fees – Bitcoin also rewards miners with transaction fees.These fees are the total fees paid by users of the network to execute transactions. recently fees have spiked to over 4 bitcoin per block.

Luck – Yes Luck. For Bitcoin miners, luck is the probability of success of finding the block reward.

Imagine that each miner is given a lottery ticket for a certain amount of hashing power they provide. If they are to provide 1 TH/s hashing power when the overall hashing power in the network is 10 TH/s, then they would receive 1 of 10 total lottery tickets. The probability of winning the lottery (in this case finding the block reward) would be 10%.

Let’s review each payment system.

Pay-Per-Share (PPS)

PPS offers an instant flat payout for each share that is solved.

- Miners gets a standard payout rate for each share completed. Each share is worth a certain amount of mineable bitcoin.

- After deducting the mining pool fees, the miners are given a fixed income every day.

- Returns are relatively stable. Miners are exposed to risk here and they also may not get the transaction fees.

This model is more lucrative during a bearish market because it is stable and more predictable.

Pay-Per-Last-N-Shares (PPLNS)

PPLNS offer profits that are allocated based on the number of shares a miner contributes.

- This method is closely related to the block mined out. If the mining pool excavates multiple blocks in a day, the miners will have a high profit; if the mining pool is not able to mine a block during the whole day, the miner’s profit during the whole day is zero.

- In the short term, the PPLNS model is highly correlated with a pool’s luck. If the luck factor of a particular mining pool decreases in the short term, the miner’s income will also decrease accordingly (the opposite case of the mining pool being lucky in the short term is possible too). However, in the long term, the luck factor tends to average out to the mean.

Pay Per Share + (PPS+)

PPS+ is a blend of two modes mentioned above, PPS and PPLNS.

- The block reward is settled according to the PPS model. And the mining service charge and transaction fee is settled according to the PPLNS mode.

- the miner can additionally obtain the income of part of the transaction fee based on the PPLNS payment method. This was a major drawback in the PPS model.

Full Pay Per Share (FPPS)

In the FPPS payment model, both the block reward and the mining service charge are settled according to the theoretical profit.

- Calculate a standard transaction fee within a certain period and distribute it to miners according to their hash power contributions in the pool. It increases the miners’ earnings by sharing some of the transaction fees.

- Miners get paid no matter if the pool finds a block or not. This is the most significant advantage over PPLNS. The risks and rewards are higher with the PPLNS plan.

- In the FPPS rewarding method, you do not need to trust anyone in order to validate your income.

- Another benefit of real FPPS rewards is that the scale and the chance of the mining pool will not affect your revenue.

Prominent Mining Pools

Several mining pools have gained prominence over the past 5 years, each offering unique features. Each mining pool caters to different preferences for plebs to industrial large scale and corporate mining needs.

Here are more details on each Bitcoin mining pools too choose from.

Braiins Pool (formerly Slush Pool)

The team at Braiins were the innovators in this space in the early days, launchinh Slushpool in November 2010.

They launched their own ASIC firmware to deal with the lack of features and ability to Increase hashrate on your ASICs and improve efficiency as much as 20%.

- Braiins pool tends to discourages pool-switching with the goal of fostering consistent participation.

- Recent news has come out that they are switching from PPLNS to FPPS payment model.

F2Pool

F2pool has been around for many years and overall, they are a well-regarded Bitcoin mining pool that offers competitive fees and efficient payouts. They also support many other crypto tokens.

- F2Pool is a geographically distributed mining pool, with miners all over the world

- After a blockchain sleuth reported that F2Pool may have censored a transaction from an address blacklisted by U.S. authorities.

AntPool

- AntPool is one of the largest and most well-known cryptocurrency mining pools in the world. Founded in 2013 by Bitmain Technologies in Beijing, China.

- AntPool allows miners to collectively contribute their computing power to mine various cryptocurrencies including Bitcoin (BTC).

- AntPool offers different mining modes such as Pay Per Share (PPS), Full Pay Per Share (FPPS), and Pay Per Last N Shares (PPLNS).

- They maintain a significant share of the global mining power for several cryptocurrencies including Bitcoin and has been recognized as one of the leading mining pools in terms of network hash rate.

- Ranked among the top pools in terms of the number of blocks mined.

BTC.com

BTC.com pool is multicurrency mining pool. They offer open source code, free management software of miners and mining farm, customized overclocking firmware to increase revenue.

- Account registration with cell-phone number or email is required

- Transparent mining data, advanced FPPS revenue model, powerful settlement center with a punctual payment promise.

Luxor pool

Luxor Tech built their bitcoin mining pool from the ground up, prioritizing efficiency, reliability, and transparency.

- Full Pay Per Share model, Developer-first API to interact with their APIs and pull miner’s stats for analysis in other systems

- Luxor allows you to create and manage up to 1000 subaccounts.

- LuxOS is their firmware for top end ASIC miners that allows you to control the miner in greater detail and be able to easily over-clock and under-clock your miners

SBI Crypto pool

SBI Crypto Pool is a mining pool operated by SBI Group.

- They offer FPPS And PPLNS+ mining pools as well as solo mining options.

- Their hashrate allocation feature allows you gain control over your mining operations especially if you’re involved in revenue sharing or selling cloud mining contracts.

Lincoin pool

Lincoin is a Canadian Bitcoin mining pool, founded by Medi Naseri and Mostafa Shariat. Lincoin offers auditable and predictable rewards through a managed FPPS (Full-Pay-Per-Share) mining pool

- The pool is running on servers in 5 continents to provide redudnacy and reduced latency.

- Advanced revenue management solution that enables advanced accounts payable management, revenue splits with time triggers and payouts to BIP47 addresses.

Laurentia pool

Lauentia pool, named after the North American Craton is focused on delivering custom, private, regional, low overhead mining pools with the expertise and support of Dr. Con Kolivas, the creator of cgminer.

- They say that they will be the first of many segregated regional pools and specifically designed, through cooperative input by a limited user base.

Kano pool

KanoPool is a Bitcoin mining pool that uses the PPLNS and Solo payout methods. This is a small pool with less than 300 nodes. They don’t findblocks often but when they do, it’s shared amoung a smaller group of miners.

- There is roughly 14.22PH/s in this pool

- Transaction fees are included in the miner reward and the pool fee is 0.5% of the total.

SECPOOL

Sec Pool offerers a safe a stable option for miners.

- They have roughly 7.1 EH/s in this pool.

- Payment model includes: PPLNS: 0$ and FPPS: 4%

solo.ckpool.org

- solo.ckpool.org is the no frills, no fuss 2% fee anonymous solo bitcoin mining for everyone.

- No registration required, no payment schemes no pool op wallets

- This is a NOT-FOR-PROFIT pool, all care is given but no responsibility is taken in the event of an issue with the pool

- Note: This is NOT a pool despite its name, it is a service to allow miners to mine solo as you cannot mine directly to a bitcoin core node

Volcano pool

- El Salvador’s first Bitcoin mining pool, Lava Pool, was launched by Volcano Energy in Elsalvador and Luxor.

- Lava Pool aims to tap into the country’s rich geothermal energy resources as part of a public-private partnership initiative

- It first started mining bitcoin using geothermal energy from its volcanoes the same year and also announced plans to issue bitcoin bonds.

New mining pools

Just in 2023, three new mining pools have entered the market. Ocean Pool, Demand Pool and Braidpool. Each of them focused on decentralizing the mining pool industry.

Ocean Pool

Ocean is the latest mining pool out there. Luke Dashjr relaunched Eligius as OCEAN pool, a centralized mining pool that aims to decentralize parts of its operation, namely block template construction and mining payouts. They found two blocks in their first week of turning on the pool with less than 500PH in hashpower.

They are offering miners control over what blocks they are mining with the following 3 options.

- OCEAN Recommended (most real financial transactions and least spam)

- Bitcoin Core with the “Ordisrespector” spam filter

- Unmodified Bitcoin Core (same as other pools with fewest financial transactions and most spam)

They are a non-custodial pool, making the miners the recipients of new block rewards directly from Bitcoin.You can join without an email or phone number and can start mining in less than 2 minutes to your bitcoin address.

Ocean pool has gotten a lot of ctritizims about censoring transaction or what they call bitcoin spam. There is a lot of discussion going on X threasts and spceas Wilson Mining wrote an interesting thread on open criticism of Ocean Mining Pool that is worth a read.

Btitcoin Magazine did a full post mortemm on the Ocean Launch.

Demand Pool

Founded by Filippo Merli and Alejandro De La Torre, dmnd.work is a bitcoin mining pool with the mission to redefine the mining pool landscape by launching a more decentralized pool with StratumV2.

You can build your own block templates + transaction sets to choose from the mempool to mine.

- Miners can maximize your earnings through our exclusive hashrate marketplace system creating unparalleled demand for your hashrate.

The future of mining pools

Decentralization and Sustainability

The future of mining pools is a shift towards smaller, more distributed pools, driven by a push for decentralization like we have seen with the recent launch of Ocean pool and Demand Pool.

New projects like Braidpool are also working on decentralizing pools with a protocol proposal for a completely decentralized mining pool, leaving no part of the pool’s role the responsibility of a centralized actor.

Braidpool aims to decouple the problems of transaction selection, variance reduction, device monitoring, and mining payout in order to enhance the businesses of both pools and individual miners.

Will be interesting to see what comes of this project.

Moreover, a growing emphasis on environmentally friendly practices, such as using renewable energy, will play into this as well.

Summary

Hope you have found this guide on Bitcoin mining pools helpful. Choosing a pool is a personal choice that you have to decide based on your needs. I have tested out several of these pools and encourage you to do the same to learn what you like and what works best for you.

If you have questions, reach out on X @craigonbitcoin and If I missed something or you have something to add, please leave a comment below.

ON BITCOIN is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

More on mining pools

Here are some of the resources used to create this guide.